Ally Financial Bank

Ally Financial

The Client

Ally Financial, with roots tracing back to its inception in 1919 as GMAC (General Motors Acceptance Corporation), boasts a storied history in the financial landscape. Evolving over the years, Ally has transformed into a prominent Detroit-based bank holding company that stands as a versatile financial powerhouse. Offering a comprehensive suite of online financial services, Ally has positioned itself as a leader in banking, investing, home loans, and auto financing. The company’s century-long journey underscores its adaptability and resilience in an ever-changing financial landscape, making Ally a trusted name for individuals and businesses seeking a broad spectrum of financial solutions.

The Problem

The problem at hand for Ally Financial lies in the potential misalignment between their target market and their online banking offerings. Despite providing top-rated online banking features, Ally faces a challenge in effectively communicating this message to its audience. The current focus on car enthusiasts, a demographic associated with the company’s prominent position as the largest car financing company in the U.S., may not fully capture the potential of Ally’s online-only financial services. This discrepancy becomes evident when considering the typical marketing strategies employed by other online banks, which often target tech enthusiasts and millennials through mobile app-centric approaches. Recognizing the need to reassess their target audience and refine communication strategies, the investigation into Ally’s website, competitors, and representative users becomes a pivotal step in addressing this marketing challenge.

The Solution

I conducted a one-week design sprint based on the design thinking methodology that includes five stages –– empathize, define, ideate, prototype and test.

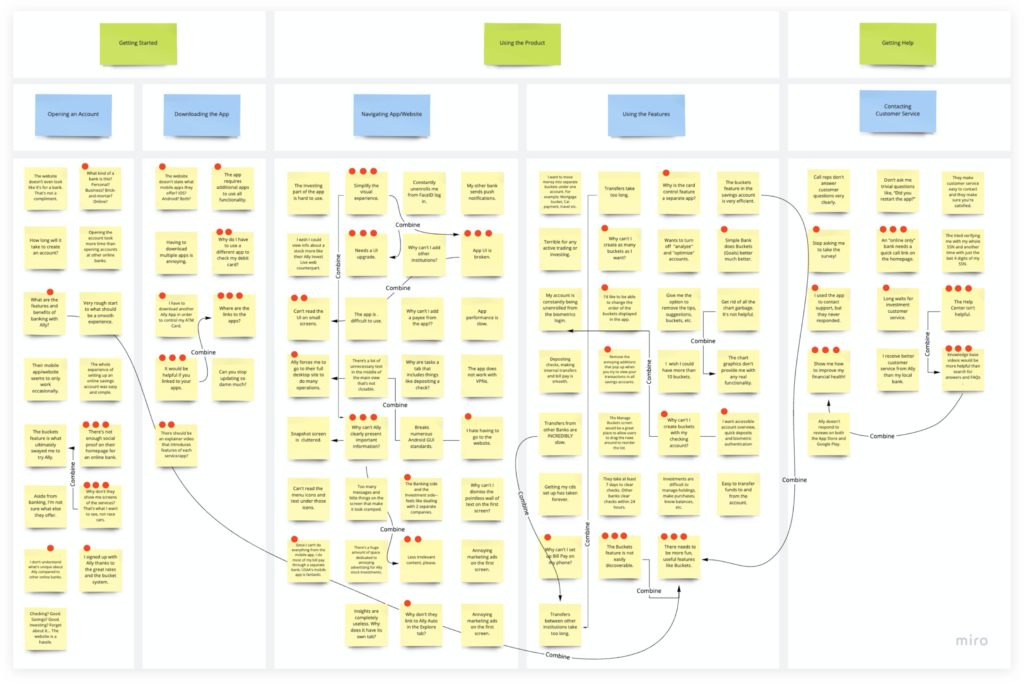

Empathize: The initial stage of the work involved empathizing with Ally Financial’s target audience. This phase centered on understanding the needs, preferences, and behaviors of potential users. Through thorough research and user feedback, I sought to gain a comprehensive understanding of the challenges and expectations users face when interacting with online banking services.

Define: Following the empathize stage, the focus shifted to defining the problem statement. By synthesizing the gathered insights, I honed in on key pain points and opportunities for improvement in Ally’s communication strategy. This phase clarified the specific areas that required attention, providing a solid foundation for the subsequent stages of the process.

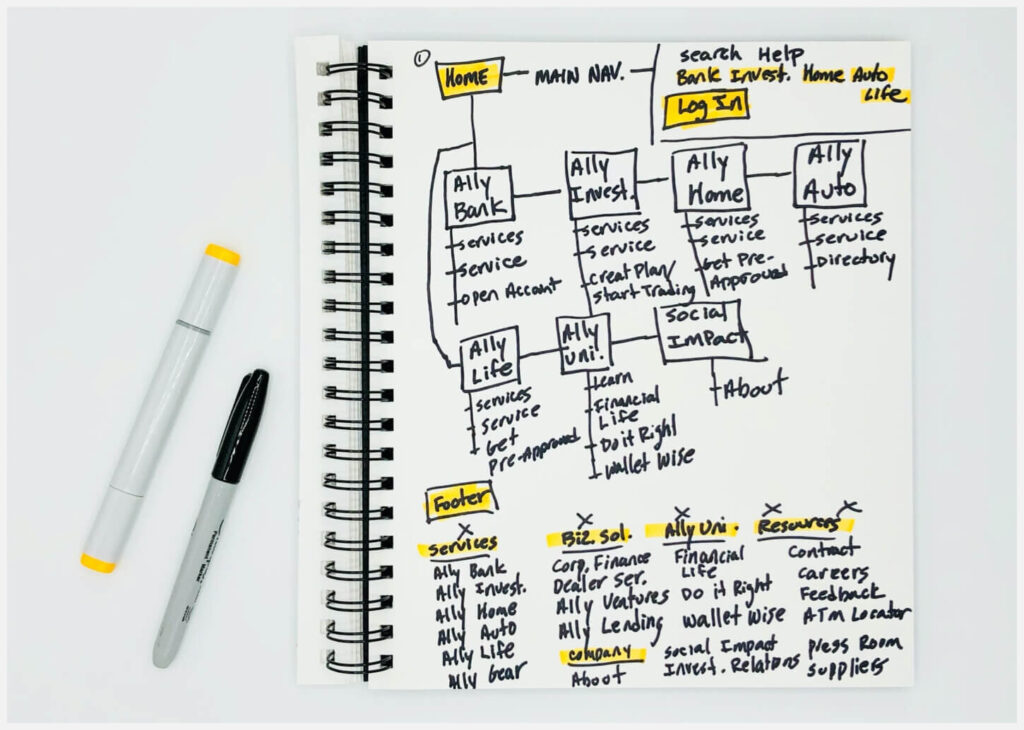

Ideate: With a clearly defined problem, the ideation stage involved generating a multitude of creative solutions. Brainstorming sessions and collaborative efforts led to the exploration of innovative approaches for effectively communicating Ally Financial’s online banking features to the intended audience. This phase encouraged diverse thinking and paved the way for potential breakthroughs.

Prototype: Moving from ideation to action, the prototype stage focused on translating selected ideas into tangible representations. Prototypes were created to visualize potential solutions, incorporating design elements, communication strategies, and user interfaces. These prototypes served as a tangible bridge between conceptualization and implementation, allowing for a more concrete evaluation of the proposed solutions.

Test: The final stage of the process involved testing the prototypes with representative users. This stage sought feedback on the proposed solutions to gauge their effectiveness in addressing the identified challenges. Iterative testing and refinement ensured that the final recommendations were not only innovative but also resonated with the target audience, aligning seamlessly with Ally Financial’s objectives.